Ipswich Unemployed Action is Retiring.

Ipswich Unemployed Action has been made by its contributors – that is the people who post in the comments.

But, having retired, and having got Pension Credit, this Blog is in a different position to when it was created.

A reminder of the aims of IUA:

“This Blog is dedicated to fighting for the rights of the Unemployed. (updated August 2011)

- Raise our Benefits to a living level.

- We want the minimum wage for any ‘voluntary’ work they make us do.

- There should be an independent appeal and monitoring system – open to all – for anyone on the Work Programme,

- We want real training, not the sham courses we have now.

- No to Workfare.

- Above all we want to be treated as human beings – not things the DWP, Providers, and Government Ministers can claim rights over. We should have rights, and we want them now!

- We want real jobs, not endless ‘job-searching’.

- And now, we want the Work Programme closed down!“

That List alone indicates how things have changed…

As somebody now on Pension Credit, and no longer on Legacy Benefits or Universal Credit, the drive for producing posts has fallen to our commentators.

This Blog is willing to help anybody who wishes to set up a new Blog with around the same kind of aims, defending the unemployed.

But for now this Blog, Ipswich Unemployed Action, is retiring.

*****

Thanks to all our contributors.

The Commenting section is now closed.

Another site covering benefit issues:

Why is ‘Lord Fraud’ attacking the Benefit Cap that he helped impose?

Johnson, Corruption and Claimants.

Tory Corruption.

You can’t ignore the events in Parliament over the last few days.

On this Blog we talk about the problems we have as claimants, or (in my case, finally, getting Pension Credit). The stand out fact is that people in that position have not much money – even when working we are not going to get well paid jobs – and all the problems that creates. When looking at the kind of cash some people have it’s hard, if not impossible, to get a grip of the kind of income some get. I would not want a town house in Knightsbridge, private jet and helicopter flights, a country mansion, or wih to eat a gold plated steak (£850 to £1,500.) at Salt Bea’s restaurant. But it’s hard to see why people should get that kind of money when others rely on Food Banks.

It’s hard to see how you get this money through ordinary work.

Then there is the political angle.

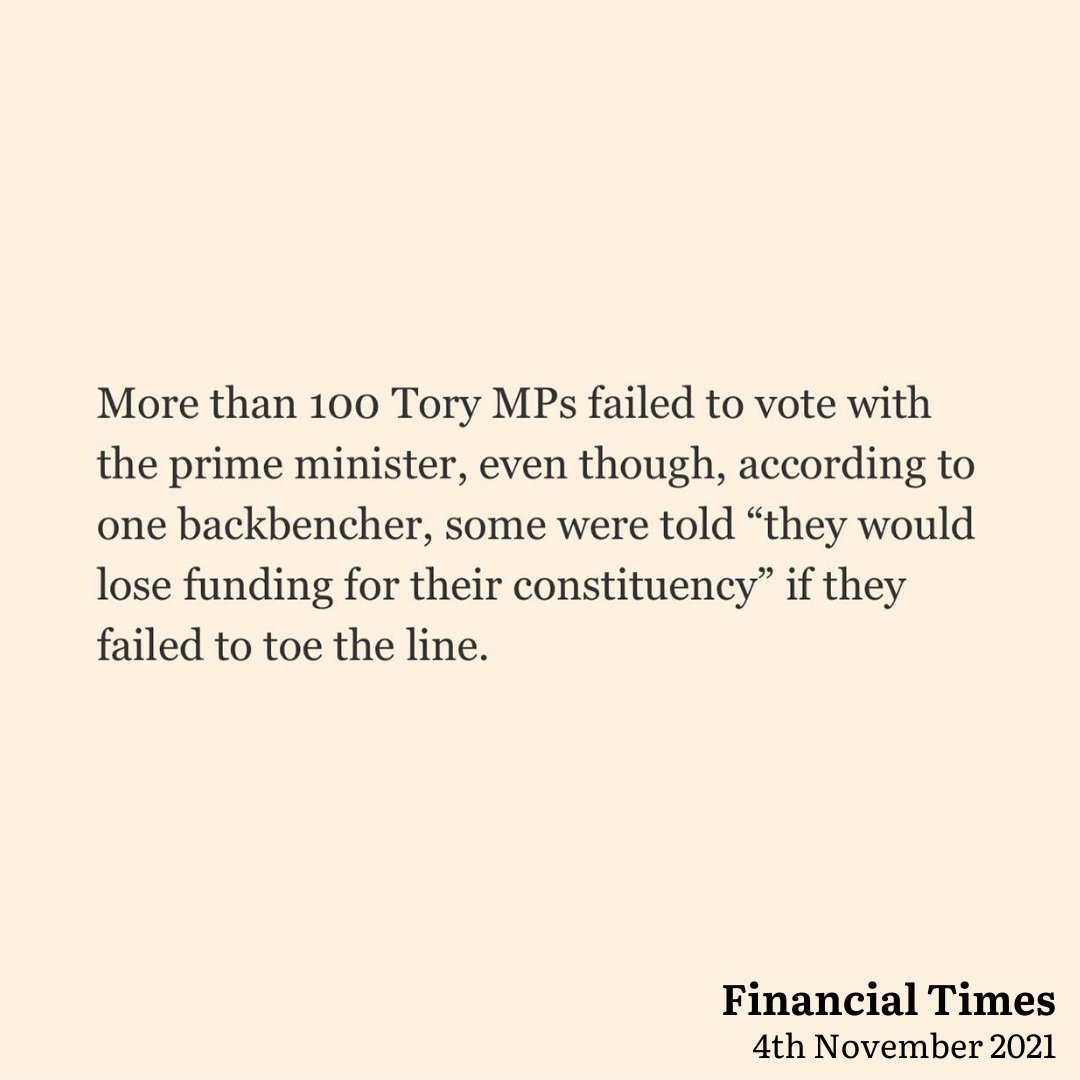

This case stands out. The gang running this government seem to have got themselves into trouble over how they enrich themselves.

This was in the ‘I’ (strongly recommended as a daily paper) yesterday.

The Owen Paterson scandal shows how corrupt our political class already is.

Patrick Cockburn.

People in the UK often fail to see the seriousness of this deteriorating situation because mealy-mouthed words and phrases such as “lobbying”, “sleaze” and “egregious cases of paid advocacy” are used. But when these activities come together they create a toxic system in which it is only the companies that invest heavily in acquiring the services of powerful politicians and civil servants who will win the big contracts and plug into government subsidies.

In the wake of the Paterson furore, much of the commentary is about Boris Johnson’s misjudgements, and there is a reinforcement of the feeling that his government is full of dodgy people doing dodgy things. Parallels are drawn with the Tory sleaze scandals of the 1990s or the parliamentary expenses scandal of 2008. But these analogies miss the point, because in both cases the amount of money involved was trivial compared to the vast sums that the politically powerful can now hope to gain.

Paterson’s overall earnings were about £100,000 a year as a consultant to two companies, which may not sound enormous, but Randox Laboratories was paying him £8,333 for 16 hours’ work a month, or about £500 an hour according to the Commons standards committee report. Lynn’s Country Foods, a processor, was paying him £2,000 for just four hours work every other month, which is about the same rate of hourly pay.

….

Honesty and dishonesty are more of a matter of habit than people care to admit. The spread of corruption is turbocharged if the fortunes to be made are large and the risk of punishment low. But the lesson of Russia, Ukraine and a host of other states in the world is that once a political class becomes corrupt, there is no way back because its members will leap to defend their own, in case they should be next in line for detection and punishment. This may not have happened yet in the UK, but, as we saw this week, it is not for lack of trying.

You do not have to look to the former Eastern bloc to see how this can happen. As a French speaker over the years I have seen many affaires involving bent politicians, the most recent involving former President Nicolas Sarkozy: Sarkozy: Former French president sentenced to jail for corruption (May 2021) (he got a suspended sentence).

This is even better known in Spain, “The Gürtel case began with one Madrid mogul. Over the next decade, it grew into the biggest corruption investigation in Spain’s recent history, sweeping up hundreds of corrupt politicians and businessmen – and shattering its political system. (Guardian Sam Edwards 2019). Spanish people got so fed up with this that some (often from the protesters who went on to support the radical left Podemos) called the politicians ‘la casta politica’, the political caste, which ruled, they considered, in its own class interests.

Now we have this: Ex-British PM calls actions of Johnson’s government “politically corrupt”

LONDON, Nov 6 (Reuters) – Former British Prime Minister John Major on Saturday attacked fellow Conservative Boris Johnson’s handling of a corruption row, saying the government’s behaviour was arrogant, broke the law and was “politically corrupt”.

Johnson was forced to make a U-turn after he abandoned plans pushed through parliament to protect a lawmaker found to have broken lobbying rules.

This:

This sums up the government’s policies more broadly:

ID Issues Hit Universal Credit.

ID seems an obsession with the crew of chancers who lead this government.

Those who follow politics know that the Tories want everybody who wishes to vote to present photo ID for elections. The fact that a few million people do not have Driving Licences or Passports is a bonus for the Conservatives. It will exclude many of the poor and marginalised from the ballot box, and make local councils (a majority in Labour areas) fork out to pay for some special scheme to allow us to have the privilege to vote. Lots of people will not bother and just give up.

It has crept down to the DWP.

There was this in October,

People are being forced to submit photos of themselves holding a local daily paper outside their home in order to claim universal credit.

The Department of Work and Pensions (DWP) verification process contains a detailed list of bizarre requests potential claimants must follow. It also includes requiring people to send in a photo taken by someone else of them holding their street sign in their right hand.

The instructions were posted in at least one person’s universal credit journal – the online platform used to manage benefit claims – by a DWP employee, according to the Public Interest Law Centre (PILC).

The Mirror reports,

Universal Credit claimants told to pay back thousands in Covid support due to ID issues

Benefit claimants who received Covid support at the height of the pandemic are being told to repay every penny back – with some claimants describing the emergency support as a ‘loan’ not a ‘benefit’.

The Mirror has spoken to dozens of people who have received sudden bills from the Department for Work and Pensions (DWP) in the past six months, asking for all the Covid support they received back.

It follows our investigation into dad Gary Blake who had been sent a bill for an overpayment because of missing ID.

In the vast majority of cases we spoke to, claimants were told to submit ID – despite already sharing it, while others were told to repay their Covid benefits because they did not have a tenancy agreement. In many cases, shortly after providing these documents, the claimants were sent a shock bill.

The Mirror continues with first hand stories, beginning with this one:

Mirror reader Sheila Richards said she received an unexpected bill for £6,000 earlier this year after receiving help during the pandemic.

The DWP allegedly told the claimant it was because she had not submitted a photo of herself.

“I had provided photo ID at my local Job Centre Plus on the many occasions that I had been asked to visit, so I didn’t consider it to be that crucial,” Sheila, who is self-employed, told The Mirror.

She is now disputing the charges with the DWP. Sheila wrote to her constituent MP but never heard back.

Still, somebody is happy at the way things are going:

New Threats to Claimants and Public Services.

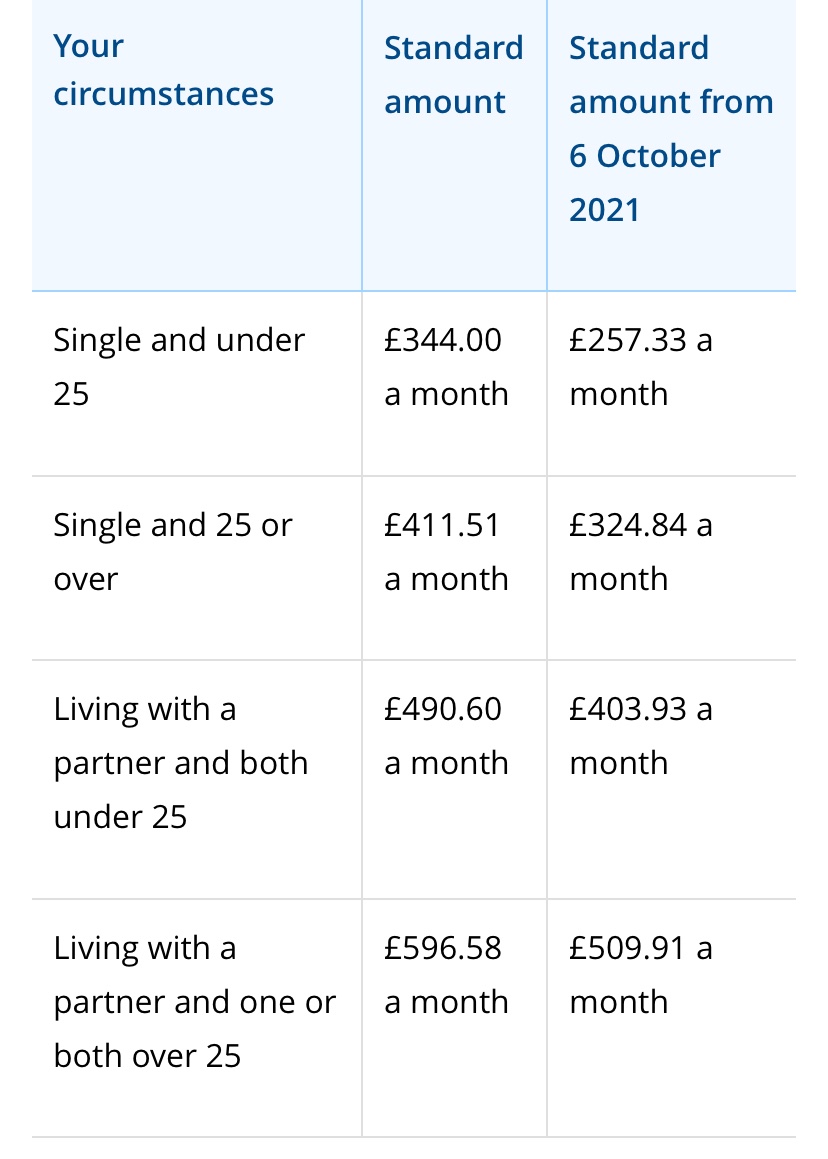

The reality of the recent cut to benefits – that is for those who got the Top Up, which did not include Legacy Claimants – is sinking in.

One thing that strikes you, and it is a long time since this writer was under 25, is the pitance single young people have to live on: £321.84 a month. You can easily pay £70 a month in gas and electricity alone (Flat). In fact that’s around what I pay. It’s a hefty chunk of any low income. My Bill, like everybody else’s, is set to rise.

Then here is this:

What is now worrying local councils is this:

The ‘I’.

Council services such as social care, bin collection, sport centres and road repairs are likely to be cut following real-term reductions in funding to councils in Rishi Sunak’s Spending Review, the Institute of Fiscal Studies (IFS) will warn.

Analysis by the IFS shows that despite sharp rises in household council tax bills and £4.8bn of new grant funding for local authorities up until 2025, any additional revenue will be wiped out by rising costs, and councils will be forced to slash at least some essential services.

The IFS found that the expected average rise in council tax bills across all councils equates to 2.8 per cent increase each year until 2025. With the average council tax bill currently about £1,428, three consecutive years of rises would mean the average household would pay £39.92 more from next April, and £123.13 more from April 2024 than they paid this year.

These are the kind of things that do not register with people, until they are affected. Things at risk include very visible services libraries and the Citizen’s Advice bureau (in Suffolk a couple of years ago the Health Trust had to step in when the Tory Council Council halved their funding for them, except that kind of thing to happen again).

For all the claims to back public transport a look at the reality shows the reality:

Councils reacted with anger, warning that unless local authorities increase council tax bills by 3 per cent – thereby forcing a referendum in which local residents will vote on the rise – then services are likely to be cut.

Sam Chapman-Allen, chairman of the District Councils Network and Conservative leader of Breckland District Council in Norfolk said: “The Spending Review does not deliver the firm financial foundation district councils need to continue delivering essential frontline services and supporting local economies to grow.

“We cannot see how the £4.8bn new grant funding announced by the Chancellor will come close to addressing the financial pressures district councils and the rest of local government are under.

“Councils face a triple whammy of rising inflation, higher wage costs from the lifting of the public sector pay freeze, and continuing pressures from the impact of Covid. This leaves councils with an unpalatable choice between increasing council tax for hard-pressed local residents or cutting services that every local resident and business relies on.”

Don’t forget that people on benefits will begin again to pay Council Tax Relief/Reduction next year, which in some parts of the country is already unfairly high.

Still somebody’s happy:

The Budget and Claimants.

The Budget was yesterday.

How does it affect claimants?

Here is the Official View:

Here is the Resolution Foundation’s view.

“The reduction in the taper rate in Universal Credit will bring an additional 400,000 families into the benefits system next year. Around 75 per cent of the 4.4 million households on Universal Credit will be worse off as a result of decisions to take away the £20 per week uplift despite the Chancellor’s new Universal Credit measures in the Budget.”

The Boris Budget (from the Summary)

Resolution Foundation analysis of Autumn Budget and Spending Review 2021

From the full report: The Boris Budget

For some, this change will be significant: a family with two adults in work (one working full-time with earnings at the 25th wage percentile and one working part-time on the National Living Wage for 20 hours a week), who have two children, will gain £42 a week from these Budget day changes, more than offsetting the £20 per week reduction made to the benefit earlier this month. But, overall, these changes will be overshadowed by last month’s £6 billion cut to entitlement: three-quarters of families on UC will lose more from he £20 cut than they gain from the Budget changes. Even if we also take into account the impact of the faster-than-average-earnings increase to the National Living Wage, the fifth of households will still be an average of £280 a year worse off overall.

Here is the real Tory view of claimants:

Then there is this:

It seems equally obvious to mention that if gas and other prices are going up what about increasing benefit levels from their present misery rates?

Next year we will begin paying Council Tax, which even at the reduced rate of Council Tax Relief can be an extra burden, and far from minimal in many areas.

Our contributors remain concerned about the way ‘schemes’ for the unemployed, outlined in ‘Plan for Jobs’ operate. Here is one Restart. Plan for Jobs: skills, employment and support programmes for jobseekers

At the 2020 Spending Review, the chancellor allocated £2.9 billion for the new Restart Scheme, which will give Universal Credit claimants who have been out of work for between 12 to 18 months enhanced support to find jobs. The Restart Scheme will break down employment barriers that could be holding them back from finding work. Providers will work with employers, local government and other partners to deliver tailored support for individuals.

Referrals will be made over a 3-year period and the Restart Scheme will benefit more than 1 million Universal Credit claimants who are expected to look for and be available for work but have no sustained earnings. The scheme will provide up to 12 months of tailored support for each participant. Early access can be considered on a case by case basis where conversations with a work coach suggest this is the most appropriate route for the individual.

It has been quite some time since the media was interested in what is happening on these ‘schemes’ but our contributors are already reporting serious difficulties with them.

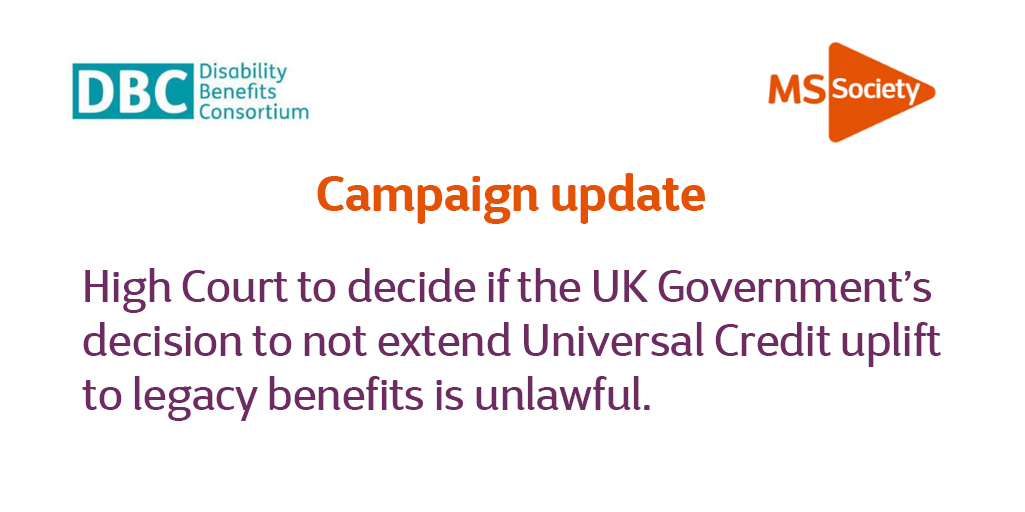

Legacy Benefits Case Continues in Court.

Case Continues.

Were it not for some of our eagle-eyed contributors this case would be ignored even on this site.

It is an injustice, not just for disabled people but for those on ” Income-based Jobseekers Allowance, Income-related Employment and Support Allowance, Income Support, Housing Benefit, Child Tax Credit and Working Tax Credit.”

Those claimants did not get the uplift when people on Universal Credit got the extra £20 a week.

There was an Early Day Motion in the House of Commons, (February 2021)

That this House recognises the financial effect that the covid-19 outbreak has had on disabled people; further recognises that research from the Disability Benefits Consortium found that over six in 10 disabled people in the survey had gone without essentials such as food, heating or medication since the pandemic began; is concerned that no uplift was provided to people on legacy benefits such as employment and support allowance, jobseeker’s allowance and income support; calls on the Government to implement a £20 uplift for legacy benefits to reflect the additional costs disabled people have faced; and further calls on the Government to commission research to assess the adequacy of benefits for disabled people.

And a debate in the House of Commons, on the 15h of September 2021 which mentioned this injustice,

Opposition Day Debate: Universal Credit and Working Tax Credits

On Wednesday 15 September there will be an Opposition Day Debate on the motion ‘That this House calls on the Government to cancel its planned cut to Universal Credit and Working Tax Credit which from the end of September 2021 will reduce support for many hardworking families by £1,040 a year.’

This uplift, however, did not apply to any other benefits, such as contributory benefits or extra-costs disability benefits such as Personal Independence Payment (PIP). It also did not extend to means-tested benefits which are being replaced by Universal Credit, but are still being claimed by many low-income families of working age. These are known as ‘legacy’ benefits and include: income-related Employment and Support Allowance (ESA), income-based Jobseeker’s Allowance (JSA), and Income Support.

There were some protests and a petition protesting against this injustice.

Government responded

This response was given on 11 March 2021

The Government has now confirmed the temporary £20 per week increase to Universal Credit remains in place for a further six months. There are no plans to extend a benefit increase to legacy benefits.

But the only avenue left now seems to be this important court case.

A disabled man from Milton Keynes is to make history with a judicial review in the High Court that could help two million other benefit claimants in the UK win a backdated amount of cash.

Ian Barrow is one of four people nationally to challenge the decision of the government not to give legacy benefit claimants an extra £20 to help them during the Covid pandemic.

All Universal Credit claimants were given the weekly ‘uplift’ but those on legacy benefits received nothing extra.

Legacy benefits are Income-based Jobseekers Allowance, Income-related Employment and Support Allowance, Income Support, Housing Benefit, Child Tax Credit and Working Tax Credit.

He is in receipt of Jobseekers Allowance and has been assessed as having limited capability for work-related activity (LCWRA).

At the beginning of the pandemic the Chancellor announced the £20 per week increase to the standard allowance of Universal Credit, but this increase was never extended to those on legacy benefits, the majority of whom are disabled, sick or carers.

A spokesman for Osbornes said the legal argument is that this action is discriminatory and unjustified. The High Court has agreed it is arguably unlawful and will decide the case later this year. The claimants have asked for the trial to be heard before the end of July 2021.

Claimants return to court for third battle with DWP in fight for universal credit justice

The high court has this week heard the latest stage in a long-running battle to secure justice for thousands of disabled benefit claimants who lost out financially after being forced onto universal credit.

The hearing, due to end today (Thursday), concerns policies that left many claimants worse off when their circumstances changed and they had to move from legacy benefits like employment and support allowance onto universal credit (UC).

Two of the three claimants taking the case – known as TP and AR for legal reasons – have already twice defeated the Department for Work and Pensions (DWP) in the court of appeal in connected cases.

Their first legal case challenged rules that meant they lost out on about £180 a month in the move to UC, because they were no longer receiving severe disability premium (SDP) and enhanced disability premium (EDP).

DWP responded by temporarily stopping other claimants in similar positions from migrating onto UC and introducing payments of about £80 month for those already affected.

TP and AR then had to take another legal case – which they also won – because this payment failed to bridge the gap between what they were now receiving and what they would have been receiving if they were still claiming ESA.

Despite the two victories, they were forced to take a third legal action after DWP announced that the level of compensation for disabled people who had been receiving EDP and SDP and had moved onto UC before 16 January 2019 – when another set of regulations came into force to protect other claimants in similar situations – would be set at a lower rate than the £180 a month they had secured through the second case.

They have been joined in the third case by another disabled claimant, AB, who has a partner and a child, and has lost out by even more.

TP and AR are currently losing out by £60 a month and AB and her partner by nearly £400 a month.

TP said last month: “It has been entirely frustrating and exhausting having to exist on an overall unreasonable cut in financial assistance brought about by a move forced upon me into universal credit, whilst at the same time battling debilitating illness during a most challenging period of increased expenditure during this pandemic.

“The principle of a fair transition into universal credit has already been upheld by the courts on numerous occasions now, yet the government has been dragging its feet for a prolonged period of time to my detriment in abiding by these rulings both in letter and spirit.”

AR added: “Yet again I am having to go to court and fight for what is fair.

“Over the last years I should have had much needed support in place to help me get through the challenges I face on a daily basis as a result of my disabilities, but instead I have had to put time and energy into fighting for that support.

“I hope this is the last time we have to fight the secretary of state for support that is so obviously needed.”

Their solicitor, Tessa Gregory, a partner at Leigh Day, said last month that it was “difficult to believe that our clients have been forced to bring a third set of legal proceedings against the government in order to ensure they and thousands of other severely disabled persons are not unlawfully discriminated against following their move on to universal credit”.

Benefits Shake up proposed: DWP considers ‘new single benefit’ for Ill and Disabled People.

New Shake Up.

Yesterday the story about a new single benefit for sick and disabled people came up.

Trev commented,

The proposed merger between UC and PIP seems to be all about preventing people from getting PIP, I reckon that’s what it’s all about.

The story has now developed.

DWP considers ‘new single benefit’ for sick and disabled people. Welfare Weekly, today).

The Department for Work and Pensions (DWP) is exploring the idea of a single benefit for sick and disabled people, it has been reported.

Some 1.4million claim Disability Living Allowance (DLA) or its replacement Personal Independence Payment (PIP) – paid to help people with the costs of being disabled. Others claim ESA (Employment and Support Allowance), which UC is replacing.

The DWP says keeping all these different benefits and having just one assessment wouldn’t work. A brand new scheme would be a way to make the whole system simpler, it says.

The proposal is included in the DWP’s recent report ‘Shaping Future Support: The Health and Disability Green Paper.’

NOTE; The Green Paper was published on the 20th of July and the consultation ended on the 11th of October.

As the Mirror points out today, “A little-reported Green Paper over the summer said a ‘new single benefit’ could combine payments – with Tory welfare chief Therese Coffey saying ‘everything is on the table'”

The Welfare Weekly article continues,

“Responding to the proposal of creating a new benefit or merging ESA, DLA & PIP with Universal Credit, Disability Rights UK (DRUK) said: “We are very suspicious of the Green Paper suggestion that Ministers could create a “new single benefit” so as to simplify the application and assessment process..

“Given the stress, worry, fear and distrust work capability assessments and PIP assessments cause Disabled people, the prospect of only having one assessment and not two is only superficially attractive at best.

“Given the repeated stress the Green Paper gives to “affordability” we believe the DWP is being disingenuous and the actual reason for the single benefit suggestion is likely to be reducing expenditure.”

Gail Ward, from the Hand2Mouth Project, said: “Those on Legacy Benefits will be Migrated to UC in 2023/24 and the merging of ESA,DLA/PIP will be a disaster for claimants and potentially means that PIP will become means tested.

“The form descriptors while having different criteria are already closely aligned and the DWP were calling PIP ‘a functional benefit’ in an evidence session before the Work and Pensions Committee recently.

……

The warning is very clearly when Therese Coffey suggested that severe disability group could be nudged into some type of work or training programme is a loud and clear message to all claimants that they want to cut overall costs and cut claimant numbers.”

Or as the Mirror notes of the DWP Minister,

Ms Coffey also suggested she was concerned by the number of people claiming PIP for mental health difficulties, saying she wanted to “target that even more so to people who really need that support”.

She added: “PIP has certainly grown in a way that was not anticipated when it was introduced.

“To give you an example, three out of four young people who claim PIP have their primary reason being mental ill health.

“That in itself is 189,000 young people who currently receive benefit focused on that. There may be other benefits they receive as well.

This seems, as our contributors have commented, part of a wider strategy to merge all benefits. The problem is, as Universal Credit has already shown, this can create bureaucratic and information technology nightmares. As well as, as he above comment about ‘affordability’ indicates, being an excuse for cutting benefit levels.

This is the Minister in Charge of the Green Paper:

Universal Credit: 70% Rise in Severe Rent Arrears.

Steep Rise in Arrears Amongst Universal Credit Claimants.

Rough sleeping remains a problem.

A day out with Derby’s rough sleepers and homeless people Derbyshire Live. October the 13th 2021.

Derby’s rough sleepers have complex problems

There are many initiatives to help with this ( How Ipswich is breaking the cycle of homelessness) , though doubtless not enough given the deep rooted causes of homelessness and the years of government neglect and a benefit system not fit to deal with people’s needs.

It looks as if more of those on benefits, are threatened with homelessness (which does not mean we will see all of them on the streets).

The cause is not their “complex problems”.

A few days ago Welfare Weekly carried this story,

Universal Credit: Homelessness fears as figures show a 70% surge in severe rent arrears.

New Government figures published today (Wednesday) reveal a 70% increase over six months in the number of renters on Universal Credit who are struggling with severe rent arrears.

The figures reveal that 190,000 low-income renters on Universal Credit in England are at least two or more months behind on their rent, with a leading homeless charity warning that a growing number of families teetering on the “brink of homelessness”.

…

This is striking,

Housing Benefit rates (and the housing costs component of Universal Credit) have been frozen since April this year. This means the rents are no longer linked to market rents, at a time when families and individuals up and down the country are struggling to cope with the economic impact of the COVID-19 pandemic.

The Story got coverage:

The Stop Mass Homelessness campaign, led by Big Issue founder Lord Bird, launched in July this year in response to spiralling debts and soaring poverty which threatens to push thousands into homelessness this autumn.

“We are literally adding fuel to the fire,” he said in response to soaring energy bills and rising poverty. “We need to keep people in their homes, or face the costly reality of a mass homelessness crisis as people are forced to choose between paying the rent or the bills.”

And, in full circle, we come back to rough sleeping:

Food Banks and Benefits.

Up till the new millenium it was rare – I had never even heard of them – to see Foodbanks in the UK. There were a few night-time soup kitchens in London, famously one run by the Salvation Army near the Embankment Tube station. They were for the homeless, a small number of people, often called “tramps” and “down and outs”.

These were times when you could still get a bath (left over from the time that not everybody had proper washing facilities at home) in a municipal facility (there was one in Ipswich round the corner, still here not that long ago). When the heating on our flat in Kentish Town broke down and working not far away, I used one, near to a hostel for the homeless in Holborn. In the same place, development on what is the Oasis Swimming Pool there, 1983 “Skeletons were found in the workhouse earth basements of the former workhouse inmates, which stopped work for a while”.

There is still a soup kitchen in the area by the Thames, Soup Runs.” St James’s Spanish Place: Operates Tuesday and Friday evenings at Lincoln Inn Fields and Embankment, Central London.”

So how have we got used to Food Banks?

Food banks developed in America where there is no real social security system, and those at the end of their tether are forced to rely on he good will and grace of others – Charity. Instead of rights you get dependence on the minimum needed to survive.

It is not accident that it was during the Regan years, when those who claim to believe that “god helps those who help themselves” grew, “According to a comprehensive government survey completed in 2002, over 90% of food banks were established in the US after 1981.” After initial criticism, “in the decades that followed, food banks have become an accepted part of America’s response to hunger.”

Something similar has happened here with those who would do away with social security and replace it with private insurance if they good in charge of the government since the 1980s, and New Labour unwilling to put benefit payments at a decent level, or to reform the punitive sanction system.

Foodbanks were rarely seen in the UK in the second half of the twentieth century, their use has started to grow, especially in the 2000s, and have since dramatically expanded. The increase in the dependency on food banks has been blamed on the 2008 recession and the Conservative government’s austerity policies. These policies included cuts to the welfare state and caps on the total amount of welfare support that a family can claim. The OECD found that people answering yes to the question ‘Have there been times in the past 12 months when you did not have enough money to buy food that you or your family needed?’ decreased from 9.8% in 2007 to 8.1% in 2012, leading some to say that the rise was due to both more awareness of food banks, and Jobcentres referring people to food banks when they were hungry.

Now, with Boris Johnson is charge, a man generously described as a “fabricator and a cheat” whose office as Prime Minister is a “triumph of political lying” (The Assault on Truth. Peter Osborne. 2021), Foodbanks are treated as essential institutuons.

Which they are. As the Trussell Trust has pointed out,

“The rapid growth in the number of charitable food banks had particularly captured public attention, as had the quantity of emergency food parcels they were distributing. Food banks in the Trussell Trust’s network distributed 61,000 emergency food parcels in2010/11, rising to 2.5 million in 2020/21.”

“Rather than acting as a service to ensure people do not face destitution, the evidence suggests that for people on the very lowest incomes … the poor functioning of universal credit can actually push people into a tide of bills, debts and, ultimately, lead them to a food bank. People are falling through the cracks in a system not made to hold them. What little support available is primarily offered by the third sector, whose work is laudable, but cannot be a substitute for a real, nationwide safety net.”

“According to an all-party parliamentary report released in December 2014, key reasons for the increased demand for UK foodbanks are delays in paying benefits, welfare sanctions, and the recent reversal of the post-WWII trend for poor people’s incomes to rise above or in line with increased costs for housing, utility bills and food.”

Just to underline the point and bring it up to date.,

The Trust also says,

It’s time for change – and that will only be possible as we raise our voices together to call for an end to the need for food banks.

We need your help. We’re calling on government at all levels to commit to ending the need for food banks and developing a plan to do so, and we need you to get involved.

Here is what is happening.

A couple of days ago the BBC ran this story.

Food banks struggle for donations as demand rises

A food bank said it is running low on donations as demand is rising due to the pandemic and people’s financial worries.

Worcester food bank said it gave food parcels to 987 people in September, a rise of 46% on the same month in 2020.

Goff O’Dowd, from the charity, said they were running short on 40 items including pasta and tinned fruit.

He said some people were desperate for help with not enough money to pay their energy bills.

The charity estimates they need 50 tonnes of food to get through until Christmas and are currently receiving about eight tonnes a month.

Culture Secretary Nadine Dorries,”Nobody” to be Pushed into Poverty by Slashing Universal Credit.

“Universal Credit cut will not drag a single person into poverty.”

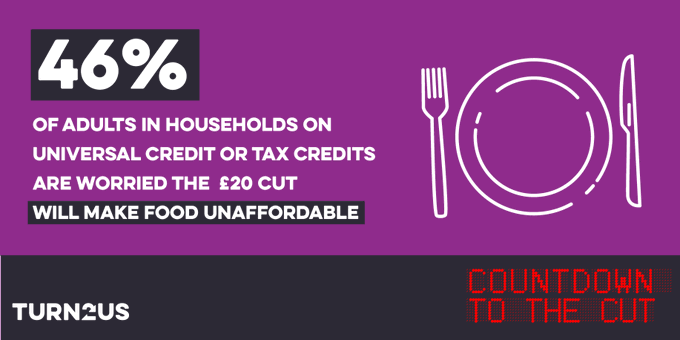

With the rise in the cost of gas and the expected increase in food prices most people on low incomes and benefits are worried. Slashing Universal Credit will not help, to say the least.

Hearing about this from people I wondered if this will help everybody, “Support with essential costs. You can contact your local council to see if they can give you any extra help from a hardship fund, including food or essential things like clothes. Check your local council on GOV.UK.”

Just guessing, but apart from those in dire straits and, above all, families, it is hard to see that applying to our contributors.

I imagine this may well offer something, judging from the queue of homeless people outside the nearby 7th Day Adventist Church on a Sunday waiting for food distribution:

Food bank vouchers. If you can’t afford the food you can ask for a referral from Citizens Advice or an organisation that’s already supporting you – for example, a charity, school or children’s centre – for a food bank voucher.

The Government itself says that everybody will be helped by getting work, with some push up from various schemes, like the “life-time skills guarantee.”

One Minister who could do with skills training in how to communicate with ordinary people has had her say on the Universal Credit cut.

Tory Nadine Dorries claims Universal Credit cut won’t push ANYONE into poverty.

Mirror.

Tory minister has been accused of not living in the real world after she claimed the Universal Credit cut will not drag a single person into poverty.

Culture Secretary Nadine Dorries boasted “nobody” will be driven below the poverty line when a £20-a-week Covid uplift in place since March 2020 is withdrawn from this week.

That is despite think tanks putting the worst-case estimate at around 500,000 to 800,000 people.

The Joseph Rowntree Foundation (JRF) has said the cut risks moving 500,000 people including 200,000 children below the poverty line.

While the Legatum Institute think tank, led by Tory UC architect Baroness Stroud, says the change will hit 840,000 Brits who are currently just above the poverty line – including 290,000 children.

But ministers have no official figure for how many people will be thrown into poverty because they’ve refused to do a formal impact assessment.

And questioned by left-wing journalist Owen Jones at the Tory conference, Ms Dorries said: “Nobody. Nobody is.

Because what we’re doing, what we’re doing is giving people a step out.

“By lifetime skills guarantee, by all the money being invested in the…” – she then walked away with an aide.

****

Some people think that Nadine Dorries is one of Boris Johnson’s famously unfunny jokes and probably only exists as a hologram borrowed from GB News…

But the scheme is a very real.

Bootcamps for Skills:

“An estimated 11 million adults now have the opportunity to gain a new qualification for free, designed to help them to gain in-demand skills and secure great jobs.

Almost 400 qualifications are available to take from today (1 April) – backed by £95 million in government funding in 2021/22 – as part of the government’s Lifetime Skills Guarantee.

The qualifications on offer range from engineering to social care to conservation and are available to any adult who has not already achieved a qualification at Level 3 (equivalent to A-levels).

The roll out marks a major milestone in the delivery of the landmark Lifetime Skills Guarantee – announced by the Prime Minister in September 2020. The Guarantee aims to transform the skills system so everyone, no matter where they live or their background, can gain the skills they need to progress in work at any stage of their lives. It will also ensure employers have access to the skilled workforce they need, and more people are trained for the skills gaps that exist now, and in the future.

Adults who take up the free courses have the potential to boost career prospects, wages and help fill skills gaps, while supporting the economy and building back better.

For example, with a Diploma in Engineering Technology adults can progress to roles in Maintenance or Manufacturing Engineering. A Level 3 Diploma in Electrical Installation or a qualification in Adult Care can also provide a gateway to sectors offering rewarding careers and where there are multiple job opportunities.

So more unemployed people can take full advantage of these courses, the government will pilot an extension to the length of time they can receive Universal Credit while undertaking work-focused study.

They will now be able to train full time for up to 12 weeks, or up to 16 weeks on a full time skills bootcamp in England, while receiving Universal Credit to support their living costs This will allow access to more training options and provide a better chance of finding work, while continuing to receive the support they need.”

Let us know if you have experience of this “bootcamp”.

Thérèse ‘Karaoke’ Coffey Hits the Headlines.

Thérèse Coffey Secretary of State at the Department for Work and Pensions Celebrating a Few Hours After Universal Credit Cut.

In an unusual move the East Anglian Daily Times (a fine local paper but one which will rarely criticise Suffolk MPs) carries this story about the MP for Suffolk Coastal. This Blog could add that while Coffey is known for a love of a good lunch, fine eating and dining, as well as cigars, her dancing and singing act has yet to be seen – correct me if I am wrong – in Suffolk pubs and restaurants.

Therese Coffey criticised for karaoke video after benefits cut

A Suffolk MP has been criticised for singing a karaoke version of (I’ve Had) The Time of My Life as a controversial cut to Universal Credit came into place.

Therese Coffey, the Suffolk Coastal MP and work and pensions secretary, performed a rendition of the power ballad with fellow Tory minister and Colchester MP Will Quince at the Conservative party conference in Manchester.

Work and Pensions Secretary Therese Coffey has been criticised for singing (I’ve Had) The Time Of My Life as she cuts universal credit payments. Ms Coffey belted out a rendition of the power ballad with fellow Tory minister Will Quince at the Conservative Party conference in Manchester in the early hours of Wednesday. Labour called the timing of her karaoke performance of (I’ve Had) The Time of My Life, as she removes the £20 uplift to universal credit for millions of people, “an insult and a disgrace

Today the paper has this story, one that our contributors know all too well.

It’s Universal Credit Cut Day!

To Celebrate the Conservative Party Conference today is Universal Credit Cut Day!

The Tories can barely conceal their glee.

Here is what is happening:

This is what this kind of money means to Tories:

Doug mentions that Johnson is due to announce a rise in the Minimum Wage.

Some might say that this increase is a cheap stunt to distract people’s attention from the fact that millions will be worse off from this Wednesday.

As if making employers pay a bit more to some people is going to help those the government is taking payments from.

Here is Thérèse Coffey retweeting:

Rishi Sunak: New (and Old) Schemes and Measures for the Unemployed.

Agenda for the Out-of-Work.

The news this Morning.

“In a speech at the Conservative Party conference in Manchester on Monday, Mr Sunak will promise new funding to help people leaving the scheme and support for over-50s looking for work, while his ‘kickstart’ scheme will also be extended.”

Metro: Rishi Sunak to announce £500,000,000 extension to ‘plan for jobs’

“Chancellor Rishi Sunak has not ruled out unemployment rising now the furlough scheme has ended, but told Sky News the government is “throwing the kitchen sink” at helping people find new roles and learn new skills. “

“In a speech at the Conservative Party conference in Manchester today, Mr Sunak will outline fresh funding for schemes designed to increase the chances of employment for those looking for work.“

Sky gives some sketchy details ahead of of today’s speech.

Within the chancellor’s new £500m package of support is an extension of the Kickstart scheme – which provides funding to create new jobs for 16 to 24-year-olds at risk of long-term unemployment – until the end of March.

Mr Sunak is also extending a Job Entry Targeted Support (JETS) scheme – for those who have been unemployed for more than three months – by another year; and he is extending a Youth Offer of guaranteed support for all young people on Universal Credit until the end of 2025.

In addition, the chancellor is extending the £3,000 incentive for firms to take on apprentices until the end of January; he will expand support from work coaches for those on Universal Credit; and he will prioritise those who have left furlough and are looking for work on Universal Credit through the Job Finding Support service u

Within the chancellor’s new £500m package of support is an extension of the Kickstart scheme – which provides funding to create new jobs for 16 to 24-year-olds at risk of long-term unemployment – until the end of March.

Mr Sunak is also extending a Job Entry Targeted Support (JETS) scheme – for those who have been unemployed for more than three months – by another year; and he is extending a Youth Offer of guaranteed support for all young people on Universal Credit until the end of 2025.

In addition, the chancellor is extending the £3,000 incentive for firms to take on apprentices until the end of January; he will expand support from work coaches for those on Universal Credit; and he will prioritise those who have left furlough and are looking for work on Universal Credit through the Job Finding Support service until the end of December.

(Job Finding Support

Job Finding Support (JFS) is part of the government’s Plan for Jobs initiative. Job Finding Support offers tailored one-to-one support to help you back into work. It’s aimed at people who have been unemployed for up to 13 weeks, and it will help you develop the skills and confidence to find and secure new employment. Your work coach will be able to advise whether JFS is right for you and if you are eligible.

If you take part you will be offered at least 4 hours of one-to-one online support focused on what will help you find work, and at least one online group session. You will receive advice and practical support to help with your job search. This could include, but is not limited to:

- help to identify your transferable skills

- advice about growth industries and jobs

- job matching to suitable vacancies and advice/links to suitable employers

- a mock interview with feedback and guidance )

And….

The package will also include a new offer for those aged over 50, with better access to information and guidance on planning for later life for those in work, and more intensive, tailored support for those who have lost their jobs.

Thérèse Coffey has got the message.

She has plans for those on disability benefits.

…she wants to focus on “what people can do, rather than the benefit system being driven currently by what you cannot do”.

Ms Coffey’s comments appear to mark a new push towards pushing people who claim disability or sickness payments towards work.

She said far more people than she expected are in the ‘support group’ – where work is not necessary – of Employment and Support Allowance, which for many is part of Universal Credit.

She also warned more young people than she expected were claiming Personal Independence Payment (PIP) – which is paid regardless of whether people work – due to mental health issues.

After Universal Credit Cut Rising Energy and Food Prices To Hit Claimants.

New Guide Out Today.

Yesterday I got notice of my coming Gas and Electricity Direct Debit. It is due at the start of October. I would say it’s already gone up by over £20 a month, and no doubt further rises are to come. People who use prepayment meters are said to spend more.

Those on benefits do not pay Council Tax, people on Council Tax Support/Reduction got an amnesty when the pandemic began. This will no doubt end in May next year. In Ipswich we are do not pay a huge amount but in some areas even those on Legacy Benefits, Universal Credit and Pension Credit, pay amounts that are enough to eat into their small amount of money.

The Independent reports today,

Families across the country will see their income drop over the next six month as rising prices and falling support combine to shave precious pounds off their available cash.

From this week, the energy price cap – the limit set on household energy costs – will increase, followed by a further projected 19 per cent increase next April, according to warnings from think tank the Resolution Foundation over the weekend.

Meanwhile, the consumer prices index (CPI) measure of inflation is widely anticipated to hit 4 per cent, its highest rate in more than a decade over the winter.

……

Karl Handscomb, senior economist at the Resolution Foundation, said: “Britain is about to enter a tight cost of living squeeze over the next six months as high inflation and rising energy bills collide with the Government’s decision to cut benefits and raise taxes.

“Low-and-middle-income families will face the tightest squeeze. Many drivers of high inflation should be short-lived, but that will be of little comfort to families struggling over the coming weeks and months.”

He states,

“The combined impact of all this could mean that from 1 October, millions of families are likely to be more than £100 worse off every month, data from Royal London suggests.

That includes around 15 million households that will be hit by the impact of energy costs, rising to a typical £1,277 for households on a default dual fuel tariff or £1,309 for the country’s 4 million prepayment customers.”

Universal Credit: ‘No snazzy meals and no posh shops for me’.

BBC.

It’s like giving somebody hope that they can manage… and then snatching the rug from underneath them.”

Tracey Rheged-Armer says she does not go to “the posh shops” or eat “snazzy meals”. Hers is instead a life of yellow-stickered, reduced price food, charity shop clothing and constantly worrying about money.

The 57-year-old care worker is one of more than 5.8 million people claiming Universal Credit who will see her temporary £20 weekly benefit boost – put in place at the start of the Covid-19 pandemic – removed from 6 October.

Tracey, from Carnforth in Lancashire, lives with her retired postman husband and a growing amount of debt.

In August, her fuel bills rocketed after her supplier put up its prices, and she now has to deal with a debt management company.

Tracey says that since she has always worked, she never expected to be in this situation.

Losing the extra £20 a week, which “goes on petrol”, will have a devastating effect on her life, she says.

“I’ll have to figure a way of putting petrol in my car, because I need [it],” she tells BBC North West Tonight.

“I can’t get to work without it, because I work awkward shifts and there’s no bus services back when I finish, so that £20 keeps me in work.”

Those of us who have lived in JSA could say that the very idea of going to expensive shops, eating out, or buying ‘snazzy meals’ would not have crossed out minds..

Today the BBC has carried out a story about this, which looks interesting:

Universal credit claimants create guide to benefit.

Universal Credit – A Claimants guide

Researchers and a group of universal credit claimants in Northern Ireland have teamed up to create a guide to the benefit.

Ulster University, which worked with the University of York, said it was the UK’s first claimant-led guide to universal credit.

The experiences of the claimants are detailed in the online document.

One of the claimants said she hoped the “go-to” would stop people getting as stressed as she did.

The guide has been officially launched just as furlough – which protected millions of jobs during the pandemic – and a £20 boost to universal credit are about to end.

It also comes amid a backdrop of rising energy and food prices.

‘Partial’ Climbdown on Universal Credit Cut?

Ministers mull partial climbdown on universal credit cut after warnings of soaring poverty

Independent.

A partial climbdown on the looming cut to universal credit is being considered by ministers, to head off fierce criticism that huge numbers of people will be plunged into poverty.

The £20-a-week reduction would stay – but working people who receive the benefit would be allowed to keep more of their earnings, under the proposal.

The so-called “taper rate” – the amount a claimant loses for every extra pound they earn – would be reduced from 63p to 60p, if the Treasury agrees the move.

Guardian:

The Currant Bun says,

Millions of Brits face a cost of living crisis this winter — with food and gas prices rising as benefits are slashed and furlough ends.

Ministers at the Department for Work and Pensions, fearing a backlash, have reportedly handed Chancellor Rishi Sunak a package of options.

This could reduce the impact of the impending cut with extra spending in other areas.

The options include giving extra cash to councils for emergency assistance funds.

Also being discussed is reducing the taper rate for Universal Credit from 63 to 60p.

That would mean workers keep more of what they earn.

It looks like few, if any, of our contributors will he helped.

This is a surprise….

Iain Duncan Smith, the man who created universal credit, trying “Commons coup on Monday by forcing a vote on the cut.”

Ian Duncan Smith the new friend of the Claimant.

Today sees more articles and tweets on the Universal Credit cut.

The Observer carries this:

Boris Johnson is warned today that more than 800,000 people risk being plunged into poverty as a result of an imminent cut to universal credit, amid a plot by senior Tories to force the government into a last-minute U-turn.

With Conservatives from across the party pressing for a compromise deal this weekend as ministers face a potential Commons revolt, the Observer has seen new analysis that suggests the impact of the £20-a-week cut could be severe with energy costs and food prices rising.

It finds that the extra support protected some 840,000 people from poverty in the second quarter of this year. The research from the Legatum Institute thinktank includes 290,000 children – a figure that is causing particular concerns among Tories, who fear a significant increase in child poverty after the cut. The figure includes extra universal credit help given to the self-employed.

This is the bit I found interesting, as an old scallywag and foe of this Blog has turned himself into a White Hatter and friend of the claimant.

Former Tory leader Iain Duncan Smith, the architect of universal credit, is attempting to spearhead a Commons coup on Monday by forcing a vote on the cut. The vote could embarrass the government should it go ahead, with another former welfare minister, Damian Green, also backing a cross-party amendment.

Duncan Smith said that the Treasury risked repeating the mistakes of austerity by trying to bring down pandemic spending too quickly. “Universal credit levels-up because it gets people back into work, back into the sense of work,” he said. “We’ve got ourselves caught, with the Treasury now demanding that we start getting the money back from Covid. We should treat this like war debt. We can’t go back into a massive cutting exercise. Ultimately, that will affect the worst-off in society.”

Senior Tories make last-gasp bid to block £20-a-week cut to Universal Credit with Commons vote

Independent.

Iain Duncan Smith and Damian Green table amendment to Monday vote on annual pensions uprating.

Senior Tories are making a last-gasp bid to block the £20-a-week cut to universal credit, by staging a Commons showdown on Monday.

They have tabled an amendment to the annual uprating of pensions, which would block the increase unless funds are diverted to stop the benefit reduction.

A defeat would not bind the government to abandon the cut – but Iain Duncan Smith and Damian Green, who are behind the move, hope it would nevertheless force ministers to act.

In the meantime this case, flagged up by our contributors, rumbles on:

High Court challenge the denial of benefit increases for nearly 2m people with disabilities

The High Court is to decide whether it was lawful of the Government not to give nearly 2million people on disability benefits the same £1040 a-year increase that it has given Universal Credit recipients.

In a decision dated 27 April the High Court granted claimants of Employment Support Allowance permission to challenge the DWP’s decision not to increase their benefit in line with Universal Credit.

At the beginning of the pandemic the Chancellor announced a £20 per week increase to the standard allowance of Universal Credit, but this vital increase to support was not extended to those on so called ‘legacy benefits’, the majority of whom are disabled, sick or carers.

The final hearing will be held 28-29 September 2021. Further updates will be posted on the website .

High Court challenge the denial of benefit increases for nearly 2m people with disabilities

“In summary the legal challenge is based on the proposition that it is clear that because of the pandemic those dependent upon basic allowances are facing higher basic living costs, and yet despite their very similar circumstances, only some of them receive a Covid-specific uplift to help meet those costs. This unfairness calls for a properly evidenced justification, particularly as very many disabled people are disproportionately affected by this decision and the pandemic generally. Thus far the Government has failed to provide any objectively verifiable reason for the difference in treatment of people in essentially identical circumstances. ”

Parliament Debates Universal Credit Cut: Tories Abstain and Vow to Ignore Defeat.

The Universal Credit cut has been raised in Parliament today

The debate was not well attended, and only a handful of Tories (seen on BBC Parliament, yup I watched it..) sat in the Chamber.

One who was there.

In the afternoon debate Beth Winter (Labour, Cynon Valley) called not just to cancel the cut but to extend the £20 uplift to those on Legacy Benefits.

Mired in a the scandal over her recent statements, – “removing the £20 uplift would only mean “two hours’ extra work every week” for claimants – Work and Pensions Secretary Thérèse Coffey, did not have the courage to address the House of Commons.

Minion Will Quince Parliamentary Under Secretary of State at the Department for Work and Pensions and MP for Colchester (not that far from Coffey’s Felixstowe homeland), said this was not a ‘cut’. It has been a “time-limited measure’ (what time limit?). To maintain the uplift would cosy (plucks figure from air) 6 Billion, if not more. The ‘safety net’ of benefits should not “trap people on welfare”. Now the government was concentrating its efforts on getting people into work.

The Labour motion was carried, 253 to Zero. All the Tories abstained. The resolution has no binding effect at all.

The motion will simply be ignored., Angela Eagle (Labour) called the Conservatives behaviour “despicable”, We ae now waiting for the (Procedurally necessary) government to respond within 12 weeks.

As the Mirror put it earlier today,

A Commons vote on axing the Universal Credit cut for six million Brits looks set to PASS today as Tory MPs are told to sit it out.

Yet Boris Johnson intends to completely ignore the result – because the vote has no legal force.

Downing Street said he will push ahead with the £20-a-week slashing next month anyway – despite today’s vote “calling on the Government to cancel its planned cut to Universal Credit andWorking Tax Credit.”

Today’s decision prompted furious recriminations from Labour, who tabled the desperate plea to stop the cut in a Commons debate and said its wishes should be carried out.

A Labour spokeswoman said: “This is a major cut that will affect millions of families across the country.

“We have given Tory MPs the chance to do the right thing. We would expect them to vote on a motion that will have a major impact on people’s lives.

Some updates from Twitter:

Food Banks Braced for Universal Credit Cut.

Food Banks Gear Up for Universal Credit Cut.

The news reports keep rolling out.

On Sunday, as this Blog has already mentioned, every Sunday there is this, just around the corner,

Several churches in the South England Conference are operating as ADRA community hubs during the COVID-19 coronavirus crisis. They are providing food, provisions and assistance in their area under ADRA’s, I AM Urban initiative.

Food for the homeless (packed lunch).

Available for collection every Sunday 12pm – 1pm.

(Seventh Day Adventist Church).

There is always a small crowd.

Now there is this news.

Ipswich food banks reopen and struggle to get supplies before benefit cut and furlough end.

Ipswich Star.

Ipswich food banks have reopened a shop and are struggling to get supplies ahead of the cut to Universal Credit and the end of furlough in October.

In addition to these “big” changes, Gareth Brenland from foodbank and homelessness charity the Bus Shelter Ipswich says at the end of next month families will have children at home without free school meals.

Mr Brenland said: “I’m concerned.

“That cut to Universal Credit affects me and is £80 a month. It will have a big impact on me.

“Last month we did 49 food parcels but I’m expecting 100s.

Graham Denny, founder and administrator of the BASIC Life Charity, who runs Ipswich and Felixstowe charity stores where you can get all your shopping for £2, is preparing for the big change.

“We’ve taken lots of provisions from Suffolk County Council,” Mr Denny said. “We’re quite aware of the challenges that are coming and how difficult that is going to be and I think we’re ready for that.”

Our Hard Right Tory MP, who spends most of his time railing against ‘Woke’ and ‘Cultural Marxism’ said this (the first time he has expressed on opinion on these fringe issues).

Mr Hunt said he did tell Mr Sunak he thinks the uplift should be permanent but pointed out the chancellor will have to make “difficult” decisions in light of the over £400 billion borrowed during the pandemic.

Around 5,790 people in Ipswich were on out-of-work benefits as of mid-July, down 145 from 5,935 in mid-June.

He added he sympathises with his constituents who are facing these challenges but said he knows from talking to Ipswich business they need staff and have lots of vacancies.

Here is the MP for the Constituency next to Ipswich,

Government Pulls Opposition Day debate on Universal Credit Cut. Instead MPs will vote on National Insurance hike.

Government pulls plans for imminent vote on universal credit cut.

Universal Credit vote blocked as government scraps opposition day

Elliot Chappell. Labour List.

Jacob Rees-Mogg has told parliament that an opposition day debate, in which Labour had been planning to force a vote on a cut to Universal Credit, will not take place so that MPs can vote on the plan to raise National Insurance instead.

The leader of the House of Commons informed MPs of the change to the schedule following a statement by Boris Johnson this afternoon, in which the Prime Minister confirmed plans to break a 2019 Tory manifesto pledge with a 1.25% levy.

Johnson announced the policy as part of the funding arrangement for his long-awaited social care plan. He presented the proposal to the cabinet this morning before coming to parliament to outline his “sustainable” plan for the care sector.

Reacting to the change in scheduling, Labour’s Thangam Debbonaire said: “This morning, cabinet was bounced into the Prime Minister’s so-called social care plan and now the leader is trying to bounce parliament into accepting it in a vote tomorrow. This is no way to run a government. It’s no way to run a country.

“This Tory tax rise won’t come in until next spring, so why the rush? Does he know that he will never get it past his backbenchers, through parliament, otherwise? Is he making sure that his own MPs have as little time as possible to consult their constituents or hear from stakeholders and experts?”

Labour had been hoping to force a vote on the government’s £20-per-week cut to Universal Credit, which will take effect from October 6th. Ministers face opposition on the move from the opposition and campaigners as well as backbench Tories.

“The government have pulled Labour’s vote on the cut to Universal Credit that would have been tomorrow to vote on the NI increase instead. I will do all I can to ensure a vote still takes place. The biggest cut in the history of the welfare state must be debated in parliament,” Jonathan Reynolds said.

***

On the issue actually debated today the TUC has issued this statement.

TUC – PM’s social care announcement is “deeply disappointing” to workforce

Commenting on today’s (Tuesday) social care announcement by the Prime Minister, TUC General Secretary Frances O’Grady said:

“We need a social care system that delivers high-quality care and high-quality employment.

“New funding for social care is long overdue. But today’s announcement will have been deeply disappointing both to those who use care, and to those who provide it.

“The Prime Minister promised us a real plan for social care services, but what we got was vague promises of money tomorrow.

“Care workers need to see more pay in their pockets now. Nothing today delivered that. Instead, the only difference it will make to low-paid care staff is to push up their taxes.

“This is so disappointing after the dedication care workers have shown during this pandemic keeping services running and looking after our loved ones.

“Proposals to tax dividends should have been just once piece in a plan to tax wealth, not an afterthought to a plan to tax the low-paid workers who’ve got us through the pandemic.

“We know social care needs extra funding. But the prime minister is raiding the pockets of low-paid workers, while leaving the wealthy barely touched.

“We need a genuine plan that will urgently tackle the endemic low pay and job insecurity that blights the social care sector – and is causing huge staff shortages and undermining the quality of care people receive.”

The TUC published proposals on Sunday to fund social care and a pay rise for the workforce by increasing Capital Gains Tax.

The union body says increasing tax on dividends is a welcome first step to reforming the way we tax wealth, but that it won’t generate the revenue needed to deliver a social care system this country deserves.

Instead, by taxing wealth and assets at the same level as income tax, the government could raise up to £17bn a year to invest in services and give all care staff a minimum wage of £10 an hour.

TUC analysis shows that seven in 10 social care workers earn less than £10 an hour and one in four are on zero-hours contracts.

Polling published on Sunday by the TUC showed that eight in 10 working adults – including seven in 10 Conservative voters – support a £10 minimum wage for care workers.

Cut in Universal Credit Dominates Benefits News.

Our contributors raise issues about benefits sanctions, work ‘coaches’, the Work and Health Programme and Training Services, which got money from the European Social Fund, Restart, the risks of opening Job Centres, Internet Access, and the State Pension and Pension Credit (well worth applying for if you have little money and, obviously, no private pension).

When this Blog was first set up we exchanged a lot of experience on back-to-work ‘schemes’, including placements in variety of companies and public services. Many had serious difficulties with them, probably most with the ‘courses’ given by enterprises like SEETEC. They now seem to be have got set up again.

But the news on Benefits remains overshadowed by the coming cut in Universal Credit.

‘We keep on struggling’: Families on Universal Credit prepare for life without the £20 uplift

Some people, on Legacy Benefits, never got that “uplift”.

Sky.

It’s just under a month to go until the £20 Universal Credit uplift, put in place amid the COVID-19 pandemic, comes to an end.

It’s being called the biggest overnight social security cut since World War Two.

This autumn, as the government seeks to claw back some of the unprecedented emergency spending undertaken since COVID-19 hit the UK, familiar security blankets like the £20 uplift to Universal Credit are set to be removed.

It won’t be without its consequences.

Doctors, charities and even some Conservative MPs are calling on the government to rethink its decision to end the uplift.

The Joseph Rowntree Foundation (JRF) says that most parts of England, Scotland and Wales will see more than one in three families and their children affected as a result of the £1,040-a-year .

The Trussell Trust estimates that nearly a quarter of a million parents on Universal Credit fear not being able to sufficiently put dinner on the table for their children when the £20 cut comes into force from October.

Benefits Boss Coffey has been on a jolly in Japan.

Local Impact of £20 a Week Universal Credit Cut: Ipswich Onwards…

Yesterday East Anglia Bylines carried this story:

Universal Credit cuts threaten Tory MPs in the East

Extracts.

The government’s planned cuts to Universal Credit will hit one family in five in East Anglia. Will the region’s Conservative MPs dare to back the Chancellor’s plan?

What about East Anglia?

In East Anglia 320,000 families receive Universal Credit, more than half of them with children. Forty percent of these claimants are in work, but not earning enough to meet the minimum needs for basic living. In every constituency more than 10% of families are on Universal Credit, and that percentage rises to over 25% in five of them (see table below). So the blow is going to be felt right across the region.

Will our region’s Conservative MP’s back the cut?

Thirty nine of the region’s 41 MPs are Conservatives, and the Party has traditionally been opposed to generous welfare benefits of any kind. However twelve of the region’s Conservative MPs have majorities smaller than the number of Credit claimants. At the extreme, in Peterborough Paul Bristow MP has a majority of only 2,580, but 18,360 voters on Universal Credit.

So the Universal Credit cut is a real threat to at least ten of the region’s MPs, especially in Peterborough, Ipswich and Norwich North, where the Conservatives hold the seat with narrow majorities.

Note, one would hope so, but people in working class Peterborough have already voted for those opposed to their own interests.

In Waveney, Peter Aldous has already written to the Prime Minister calling for the cut to be cancelled. It will be interesting to see how large a rebellion there will be on the government benches when the issue comes to Parliament. Will our MPs be prepared to inflict cuts on such a large proportion of their own constituents, or will they swallow their traditional principles, and vote to block this cut?

Note, it is to be very much doubted that (many?) others will follow, though some might. The hard right Ipswich Tory MP Tom Hunt is more obsessed with fighting ‘cultural Marxism’ than standing up for constituents on Universal Credit.

One can hardly avoid mentioning that the MP for Suffolk Coastal, which adjoins Ipswich is this figure is the DWP Minister carrying out the brutal cuts…

Where will the cuts bite hardest?

The constituencies most affected are listed here. All are held by Conservatives (we highlight one..)

| Constituency | County | MP | 2019 Majority | Families on universal credit or working tax credits | Percentage of families on universal credit or working tax credits |

| Ipswich | Suffolk | Tom Hunt | 5,479 | 12,200 | 24.3% |

Yesterday the Ipswich Star published this:

‘Massive impact’ as 58,000 people to lose £20 a week in benefits

Citizens Advice has found itself helping many more younger people during the pandemic, with Mrs Harrison saying the “jobs they were in are no longer there”.

She has argued that a “delay would be ideal – especially to try to get over the winter period”.

Waveney (Note, this includes Lowestoft which has a large working class and some very poor areas) MP Peter Aldous is one of those calling for the £20 a week uplift to be made permanent.

Today, local press is doing its job.

‘Forced to live off £8.30 a day’ – man’s fear at impending benefit cut.

The princely sum of £8.30 might buy you a cinema ticket, a meal for one at a restaurant or a couple of ready meals from the supermarket.

But one Universal Credit claimant from Suffolk is facing up to the harsh reality of a life where that will be his daily budget – as he braces himself for a £20 a week cut to his benefits.

The claimant, a young autistic adult with chronic fatigue syndrome, was an electrician before the pandemic and lost his job in a kitchen as the Covid crisis started.

Since then, the man – who has asked us not to use his name – said he has been “struggling on the benefit system”.

This is a familiar story to our readers,

He says this is “barely enough as it is” – but with the government set to remove the uplift on October 6, the claimant is now asking: “How do they expect everyone to survive?”

“It will cause devastation to so many families across the UK,” said the man, who is one of 58,069 people in the county claiming Universal Credit.

“I can barely afford the things I need with the £20 uplift.

The details makes it worse.

When it gets reduced, people will be forced to live off of £8.30 a day, roughly. This is disgusting and cannot be allowed to happen.”

The claimant also argues the the DWP’s removal of the uplift contradicts letters he has had from the Department of Health and Social Care (DHSC), which warn of the continuing dangers of Covid-19.

“How on one side can the DWP cut off financial support to the most vulnerable people in our society, with the excuse of ‘this was only a temporary increase because of the coronavirus pandemic’, and then on the same day the DHSC can send me a letter saying that Covid-19 remains a threat?.

“So the DWP is saying we don’t need to provide you extra financial support, but the DHSC is saying that the virus remains a threat? It is so ignorantly stupid and a contradiction.

“The Covid-19 pandemic is very much still happening. Those who are vulnerable and disabled in our society still do not feel safe to return to normal.

“The DWP cannot be allowed to get away with this.”

Hats off to the Ipswich Star and the East Anglian Daily Times for the report.

This story can be reproduced across the country, and it is not hard to imagine our contributors having worse experiences of living on existing benefits. Not hard because many have written about it.

There are of course those on Legacy Benefits who never got the uplift.

UK Government urged to scrap plans to axe £20 Universal Credit increase.

ITV.

Ministers from Scotland, Wales and Northern Ireland have called on the UK Government to scrap plans to axe the £20 increase to Universal Credit and instead make the higher rate of payment permanent.

In a letter to Work and Pensions Secretary Therese Coffey, they branded the change, which is due to come into effect in September, as the “biggest overnight reduction to a basic rate of social security since the modern welfare state began, more than 70 years ago.”

Ministers from Holyrood, Cardiff and Stormont raised concerns about the impact the reduction would have on poverty.

Johnson – Universal Credit Claimants Should Rely On Their Own ‘Efforts’ Not Welfare.

There’s been a flurry of stories about the Universal Credit cut today:

But this stands out.

Boris Johnson Says Universal Credit Claimants Should Rely On Their Own ‘Efforts’ Not Welfare.

“Boris Johnson has defended planned cuts to Universal Credit by suggesting claimants should rely on their own “efforts” rather than accept “welfare”.

The prime minister shrugged off a growing Tory rebellion over the removal of the £1,000-a-year top-up to the benefit, which was introduced to cushion the impact of the Covid pandemic on low-income families.

Everyone on Universal Credit and Working Tax Credit will see the uplift axed on October 6 and a new report warned that households in more than 50 Tory marginals won in 2019 would be among those hardest hit.”

The man who looks like adopting the Bertie Wooster strategy before the Beak of ‘sout denial’ continues

But Johnson made a robust defence of the benefit cut plans, declaring that it was better for people to get more money by working harder than by relying on income that came from other taxpayers.

“My strong preference is for people to see their wages rise through their efforts rather than through taxation of other people put into their pay packets, rather than welfare,” he said.

He added: “The key focus for this government is on making sure that we come out of Covid strongly, with a jobs-led recovery, and I’m very pleased to see the way the unemployment numbers, the unemployment rate has been falling, employment has been rising, but also wages have been rising.”

However, critics point out that many of Universal Credit and Working Tax Credit are actually in work, but are on low wages.

Meanwhile our all-heart Minister is here:

Universal Credit claimants get text message about the £20 uplift ending in September.

Berkshire Live.

A £20-a-week uplift was introduced in April 2020 to help alleviate the financial burden of the pandemic, but 17 months later the money is set to be cut.

Charities, opposition parties and Conservative MPs are calling for the UK Government to rethink the decision to end the payments in September, the Daily Record reports.

…

“You couldn’t make this stuff up. I phoned the DWP and they confirmed similar messages had been sent to millions of people.

“We have backbench Tory MPs campaigning for the £20 a week uplift to stay, yet the UK Government is ploughing on regardless and telling us via text message.

“This will create a perfect storm of poverty and social distress across Scotland and the rest of the UK.”

Veteran anti-poverty campaigner Sean Clerkin told the Daily Record that the cuts will create ‘the perfect storm of poverty’, saying: “The message told me I had been receiving an extra £86.67p since April 2020, which was a temporary increase because of the coronavirus pandemic.”

“It added the increase will end soon and my payment on September 17 would be the last time I received this amount.